Types of Data Analysis

Types of Data Analysis

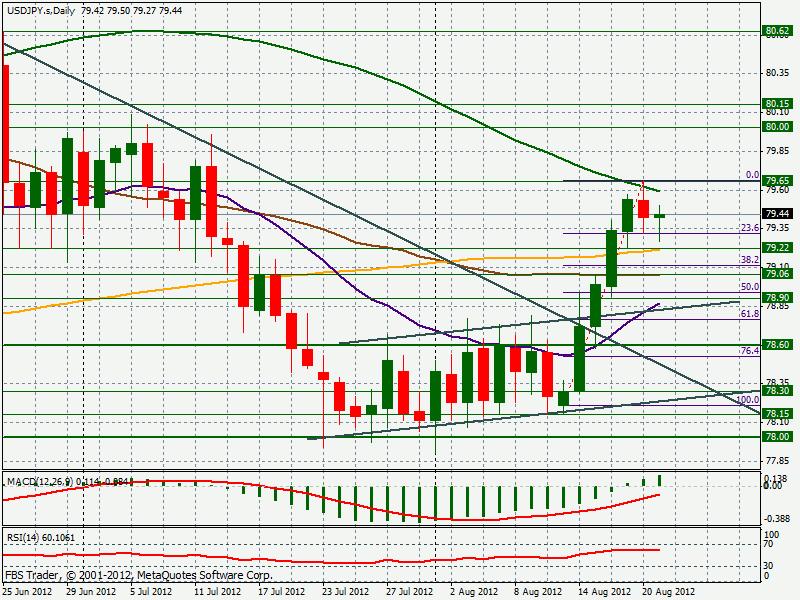

Forex.com charting

While we separate these into categories, they are all linked together and build upon each other. As you begin moving from the simplest type of analytics to more complex, the degree of difficulty and resources required increases.

As a result, Malkiel argued, stock prices are best described by a statistical process called a "random walk" meaning each day's deviations from the central value are random and unpredictable. This led Malkiel to conclude that paying financial services persons to predict the market actually hurt, rather than helped, net portfolio return. A futures forex contract is traded on a regulated market, for example, a commodity exchange, like the Chicago Mercantile Exchange (CME). When you trade futures, your counterparty is the exchange and the specifics of the contract are predefined by the exchange. When your counterparty is a regulated exchange, you don't need to check your counterparty risk, as this is one of the safest modes of trading.

There are different types of trading indicator, including leading indicators and lagging indicators. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. The long straddle is an example of an options strategy composed of two legs, a long call and a long put. This strategy is good for traders who know a security's price will change but aren't confident of which way it will move. The investor breaks even if the price goes up by her net debit – the price she paid for the two contracts plus commission fees – or if it decreases by her net debit.

This is always the case when you trade forex with your online brokers. The rollover happens because when you are betting on the direction of a currency pair, you do not want to actually convert money into the other currency, you just want to bet on the price movement. EURUSD bid priceEURUSD ask price1.17001.1705First of all, you need to understand what the bid and the ask prices are.

See how the parameters affect the signals you get from the indicators, and whether this gives you better entries, or helps you to catch better trends. ADX above 50 (green line), strong trend, chart via TradingViewADX can also help you to exit the trade when the trend weakens, to avoid getting caught by price retracements.

Predictive analysis attempts to answer the question “what is likely to happen”. This type of analytics utilizes previous data to make predictions about future outcomes. Analysis of data is a vital part of running a successful business. When data is used effectively, it leads to better understanding of a business’s previous performance and better decision-making for its future activities.

After 30 days, they will exchange the currencies and the company will receive €85,397 ($100,000/1.1710). However, in most cases, the settlement doesn't actually happen, because spot contracts are rolled over before the settlement.

This means that it lags behind price quite a lot, so might not be the best indicator to use if you want to get into trends early. Senkou span as dynamic support and resistance, chart via TradingViewThe Kijun Sen (blue line) can be used to confirm trends. If the price breakouts above the Kijun Sen, it’s likely to rise further. Conversely, if the price drops below this line, then it’s likely it’ll go lower.

Traders using this approach focus on short term gains as opposed to long term valuations. For example, a trader may be interested in stocks that broke out from their 50-day moving average as a buying opportunity. Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. Automated forex trading is a method of trading foreign currencies with a computer program. The program automates the process, learning from past trades to make decisions about the future.

Nowadays, in this category we can include EUR/USD, USD/CHF, GBP/USD, and USD/JPY. These are the major pairs traded by the majority of the banks all over the world and also by all important institutions and traders, being the most followed by scalping fans. What is important regarding this category of currencies for scalpers is that they move slowly in the markets and that they have the biggest amounts of trading in terms of volume. You can use 400 technical indicators and the charts are easily editable. The number of indicators TD Ameritrade offers is one of the most extensive on the market.

- Do not use Parabolic SAR in a ranging market, when the price is moving sideways.

- Kijun Sen breakout into an uptrend, chart via TradingViewThe Tenkan Sen (red line) can also be used to confirm trends.

- This principle goes along well with the theory that a business is all about profits and nothing else.

- And given the often-cyclical nature of trading patterns, they're also key indicators of how prices will move and change in the future.

- Technical analysis seeks to predict price movements by examining historical data, mainly price and volume.

When the mimicry is high, many stocks follow each other's movements - a prime reason for panic to take hold. It was shown that a dramatic increase in market mimicry occurred during the entire year before each market crash of the past 25 years, including the financial crisis of 2007–08. Fundamental analysis is built on the belief that human society needs capital to make progress and if a company operates well, it should be rewarded with additional capital and result in a surge in stock price. Fundamental analysis is widely used by fund managers as it is the most reasonable, objective and made from publicly available information like financial statement analysis.

On day 1, the price closed below the Kijun Sen (blue line), indicating that the price might go lower. If you were using the Ichimoku by itself, you might’ve entered the trade here. As with many trend indicators, ADX lags behind the price, so is not useful if you want to get in on trends early. Parabolic SAR points, chart via TradingViewOne thing to be aware of. Do not use Parabolic SAR in a ranging market, when the price is moving sideways.

Significant differences between forex trading and stock trading are that forex market is global in nature, moves on 24/7 basis and regulation remains limited. This leads to highly sensitive, unpredictable and susceptible variations in forex price movements. Primary drivers of forex rates include news items e.g. issued statements from government officials, geo-political developments, inflation and other macro-economic figures, etc.

Statistics science is used widely in so many areas such as market research, business intelligence, financial and data analysis and many other areas. By contrast, a bottom-up approach to technical analysis includes looking for potentially undervalued stocks and examining them on a more fundamental basis to find a point of entry where the stock looks like it's bottomed out. Indicators can be "lagging" or "leading," meaning that they're either using past data to help describe what's happening to a stock's price or that they're predicting future price action.

The efficient-market hypothesis suggests that stock prices reflect all currently available information and any price changes that are not based on newly revealed information thus are inherently unpredictable. Others disagree and those with this viewpoint possess myriad methods and technologies which purportedly allow them to gain future price information. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy.

As the bread and butter of technical analysis, chart patterns are one of the main ways analysts examine and predict where a stock or security will trade down the road. Because of this assumption, technical analysis frequently looks at chart patterns to track how the market acts over time and how prices change, using that as a potential predictor for future price movements. As most forex traders already know, scalping strategies involve short-term transactions to bring profit. It can be defined as being a highly specialized trading method, which requires strong technical and fundamental analysis knowledge and favorable technical setup in order for the scalper to profit.

Technical analysis is rather used for short-term strategies, than the long-term ones. And therefore, it is far more prevalent in commodities and forex markets where traders focus on short-term price movements. Whether you’re interested in forex trading, commodities trading or share trading, it can be helpful to use technical analysis as part of your strategy – and this includes studying various trading indicators. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. As a general rule, technical analysis prizes the current or past price of a security as the best indicator of the future price of that security.

The overall market, economic data, financial statements and fundamentals can all be beneficial factors to examine when looking at a new investment -- whether a stock or another kind of security. Don’t get too attached to the direction of the market, as long as the price is moving you can profit. Finding out the true value can be done by various methods with basically the same principle.

If you add too many rules, you might be curve fitting your strategy (to past data) and it’ll probably fail in the live markets. If you’re lazy and don’t want to make any changes to the trading strategy, then move on to the next step. Most research papers provide the trading strategy — and the backtest work is also done for you.

They each serve a different purpose and provide varying insights. Moving from descriptive analysis towards predictive and prescriptive analysis requires much more technical ability, but also unlocks more insight for your organization. There are four types of data analysis that are in use across all industries.

Комментарии

Отправить комментарий