Learn How To Trade Forex

Learn How To Trade Forex

Successful traders want to refine and perfect their methods. Once you have developed a method, practice implementing it with precision. Results come from good execution of a plan, so focus on the plan and results take care of themselves. Adapt to market conditions and study how your strategy can be adapted to changing market conditions–do this before market conditions change.

For almost 4 years, I have shared all my technical price action trading strategies with the public in my trading course and members’ community. I provide aspiring traders with the necessary pieces of the puzzle, but it is up to them to put them all together, I cannot do this for you. There are many “human” elements to trading that will require much effort on your part to master. If you can master the technical aspects that I teach along with the human elements, trading for a living is a realistically achievable goal for you.

There are no guarantees of anything in trading, so all we can do is focus on following a plan, relentlessly on every trade. And our success (and the time it takes) is dependent on our ability to actually do that. It is essential to treat forex trading as a business and to remember that individual wins and losses don’t matter in the short run. It is how the trading business performs over time that is important. As such, traders should try to avoid becoming overly emotional about either wins or losses, and treat each as just another day at the office.

You may not be able to see all the price data for the current day on your tick chart. Seeing what has occurred throughout the day is important for monitoring trends, overall volatility, tendencies, and strong intraday support and resistance levels. To reveal all the price data for the day, open a separate one-minute or two-minute chart to reveal the entire day's price action. The one-minute and two-minute charts are especially helpful in assessing trends, monitoring major intra-day support and resistance levels, and noting overall volatility.

That is assuming you are practicing every day for several hours and practicing methodically. For many people it will take longer; a year is not unreasonable. Make sure you’re financially prepared, and don’t give up other income sources until your trading income is enough to live off of. Even then, always opt for having multiple streams of income.

As well as being part of Soros' famous Black Wednesday trade, Mr Druckenmiller boasted an incredible record of successive years of double-digit gains with Duquesne, before his eventual retirement. Druckenmiller's net worth is valued at more than $2 billion.

And like our other successful Forex traders, the Sultan believes market perceptions help determine price action as much as pure fundamentals. Here we see Soros' strong appreciation of risk/reward - one of the facets that helped carve his reputation as arguably, the best Forex trader in the world. Rather than subscribing to the traditional economic theory that prices will eventually move to a theoretical equilibrium, Soros deemed the theory of reflexivity to be more helpful in judging the financial markets.

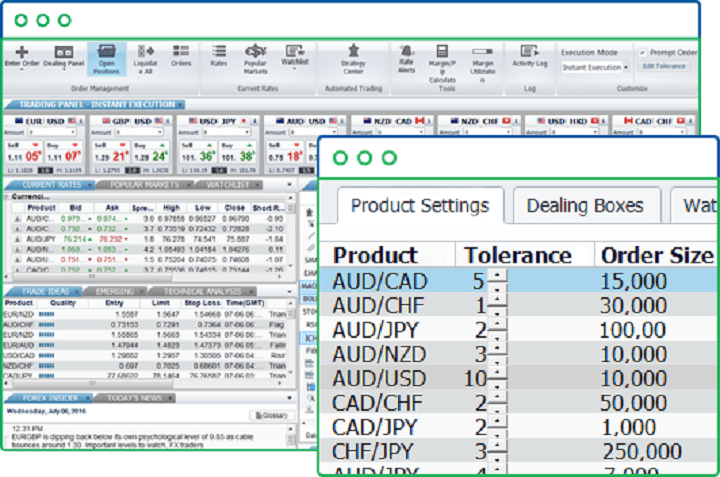

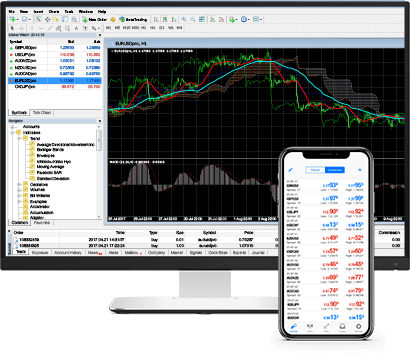

You open an account, deposit funds, then use the broker's trading platform to buy and sell currency using margin. Forex markets are open 24 hours a day, five days a week. For learning the basics, we recommend the School of Pipsology or the NFA's Trading Forex booklet. Nearly all forex brokers offer mobile applications, and some of the individual broker apps are so popular that traders who don't have accounts with the broker still use its apps. Other popular forex trading apps offer free and easy access to news, price quotes, and charting.

So, in my opinion, trying to make smaller amounts than you would otherwise will not necessarily make the learning curve shorter. Swing trading and day trading are both viable, have a higher return potential (in practiced hands) than passively investing, but also take time to master.

When starting out you may experiment, watching different patterns and then seeing how the market reacts to them, but as quickly as possibly you want to develop some guidelines based on what you notice. As quickly as possible you want to start developing these types of guidelines…telling yourself you will only enter the market when X Y and Z are happening. Then you work on stop loss placement and target placement (or when to get out, in other words). This way, we aren’t doing random untested things all the time. We are only trading patterns that we know provide us with an edge, and we trade them in a very similar way all the time.

- Also, in this article you say to master the daily charts yet most of your other material focuses on the 4h.

- If you are only putting in an hour a day, it could take you longer to become profitable.

- This can create the illusion of activity during slow trading periods, but traders who see that the tick chart isn't creating new bars will know there is little activity.

- This is true for full time traders as well as the most casual day trader.

We’ll show you whether it’s possible to start trading with a very small amount like $100. For a beginner, the most essential thing should be regulation. Spreads, leverage, platform and educational resources are also important. Yes, there are forex brokers who offer no minimum deposit. So, you don’t need to deposit high amount to start trading.

In either case, the tick, one-minute, and two-minute charts may not show the entire trading day (or, if they do, the chart will appear squished). Therefore, continue to trade on your tick chart, but have a four-minute or five-minute chart open. Late in the day, these longer-term charts will help show the day's overall trend. They will also make major support and resistance levels clearly visible.

Interactive Brokers vs. TD Ameritrade

Webull’s trading platform is designed for intermediate and experienced traders, although beginning traders can also benefit. Webull is widely considered one of the best Robinhood alternatives.

Continually be asking yourself…”If the market becomes more or less volatile, or if it shifts from trending to stagnant (or vice versa), how will this affect my strategy? ” The article How to Day Trade the Forex Market in Two Hours Lessdiscusses these concepts. Your trading stats, based on your initial months of demo and live trading will give you an idea of your income potential. If you make 10% per month in your first profitable months, multiply your account size by 0.1 (or 10%) to get your approximate monthly income.

Each country outside the United States has its own regulatory body with which legitimate forex brokers should be registered. When choosing any financial management platform, it’s important to look for trustworthy providers.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. There are many other tools like Wave59, and VectorVest in the market. The top picks from Trading Fuel are known for giving accurate results. Seasoned traders can use applications as per their trading strategies. If you have already tried multiple system, you can choose the best suitable to you.

Your course and lessons are priceless especially for beginners who consistently are loosing money in the “easy money forex world”. I totally agree that consulting a mentor like you is very much needed for traders like me.

Working a full-time job means you can’t afford to make mistakes, unless you want to remain in the ranks of the less successful, casual traders. You literally do not have the time to work through the problems, spot the right course of action and then move accordingly.

Комментарии

Отправить комментарий