Risk-On Risk-Off Definition

Risk-On Risk-Off Definition

Stocks are the most obvious risk-on type of investments, especially those with higher price-to-earnings ratios or that may be more dependent on economic growth. Additionally, lower-rated, high-yielding bonds or corporate debt are considered "risk-on" as are emerging market currencies. As these types of assets are purchased, defensive assets such as gold and bonds are sold. Sentiment indicators are best used in conjunction with other forms of technical and fundamental analysis to help confirm market or economic turning points. Sentiment indicators can be used by investors to see how optimistic or pessimistic people are about current market or economic conditions.

Consumer confidence rebounded in July 2019 after declining precipitously in June 2019 on the heels of an escalation of trade tensions with China. The CCI is released on the last Tuesday of every month and is widely regarded as the most credible gauge of U.S. consumer confidence.

However, because forex trading takes place over-the-counter, the absence of a centralized market complicates knowing the volume of every currency traded. Likewise, if a plummeting stock abruptly reversed its move because of increased volume, it could point to shifting market sentiment, from bearish to bullish. For example, if 90 traders have placed buy orders on the GBP/USD and 10 traders have placed sell orders on the currency pair, it shows the sentiment to be 90% overall in favor of buy positions. Knowing how to use sentiment analysis can be a vital tool in your toolbox.

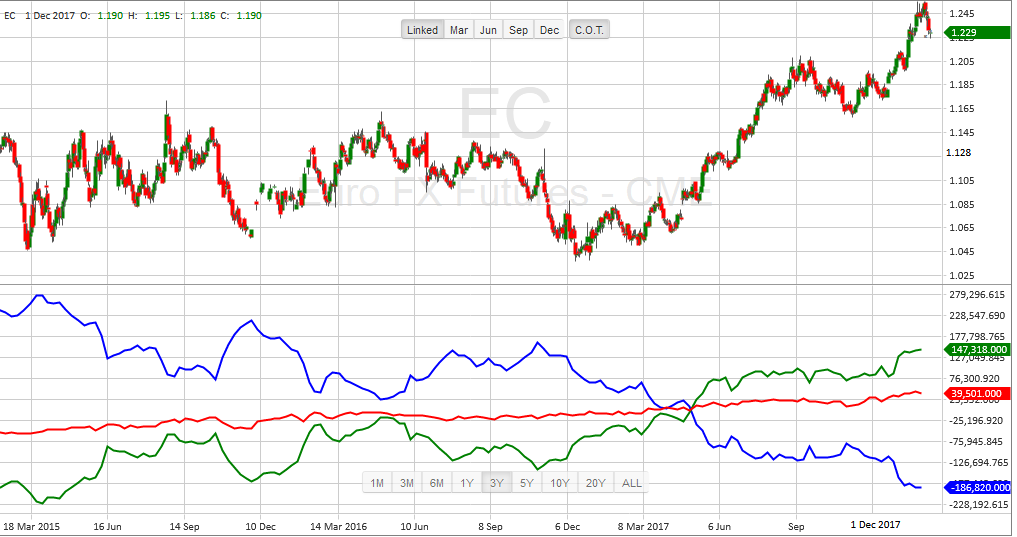

Weakness in Japanese yen futures (US dollar strength) will likely push the USD/JPY higher. Statistics are available for all futures contracts traded, and open interest can help gauge sentiment. Open interest, simply defined, is the number of contracts that have not been settled and remain as open positions. Large speculators (green line) trade for profit and are trend followers. Commercials (red line) use futures markets to hedge, and, therefore, are counter-trend traders.

With so many participants - most of whom are trading for speculative reasons - gaining an edge in the forex market is crucial. Fundamental analysis provides a broad view of a currency pair's movements and technical analysis defines trends and helps to isolate turning points.

#2 TD Ameritrade Web trading platform 4.0

We test brokers based on more than 100 criteria with real accounts and real money. When risks subside in the market, low-return assets and safe havens are dumped for high-yielding bonds, stocks, commodities, and other assets that carry elevated risk. As overall market risks stay low, investors are more willing to take on portfolio risk for the chance of higher returns. In risk-on situations, investors have a high risk appetite and bid up the prices of assets in the market. Risk-on environments are often carried by a combination of expanding corporate earnings, optimistic economic outlook, accommodative central bank policies, and speculation.

Although the report is not real-time, the data is still very valuable to assist forex traders who want to use it for gauging the prevailing market sentiment and taking intermediate and long-term positions. The contrarian trading strategy involves placing orders that are against the present market sentiment. Contrarian traders mostly place long orders when a currency is weak and short orders when it’s strong. A wide range of business and economic policy-makers take consumer attitude surveys very seriously. At the beginning of 1989, the Bureau of Economic Analysis of the U.S.

- A Bearish trending market is a market that is decreasing in price over time.

- When consumers report that they expect to feel better off in the future, current expenditures stagnate as consumers delay purchases until a better time.

- For instance, a trader can place a buy order on a currency pair when growing pessimism has made its price to plummet to extremely low levels.

- While some brokers publish the volume produced by their client orders, it does not compare to the volume or open interest data available from a centralized exchange, such as a futures exchange.

- The Washington Post-ABC News Consumer Comfort Index is a consumer confidence index based on telephone interviews with 1,000 randomly selected adults over the previous four-week period.

Returns and Risk-On Risk-Off

They provide a very good summary of consumers' perception of the current state of the economy. Consumers' confidence or uncertainty can be affected by a lot of things, such as political news or media personalities, that are not captured by aggregate economic data. It behooves us to watch the various consumer attitude surveys carefully.

Forex sentiment indicators come in several forms and from many sources. Using multiple sentiment indicators in conjunction with fundamental and technical analysis provides a broad view of how traders are manoeuvring in the market. Sentiment indicators can alert you when a reversal is likely near - due to an extreme sentiment reading - and can also confirm a current trend. Sentiment indicators are not buy and sell signals on their own; look for the price to confirm what sentiment is indicating before acting on sentiment indicator readings.

Sentiment forms a significant component of what drives movements in the forex market. For example, if the dominating sentiment is bullish for a currency pair, it will rise in value. Note that using sentiment analysis will not provide you with specific entry and exit places for every trade—but it will assist you to know whether to ride with the flow or not.

The ZyFin India Consumer Outlook Index is a monthly index of consumer sentiment in India. The COI is designed to provide reliable insights into the direction of the Indian national and regional economies. Released once a month, the index is computed from the results of a monthly survey of 4,000 consumers in 18 cities across India.

View current trader sentiment and discover who is going long and short, the percentage change over time, and whether market signals are bullish or bearish. After broadly positive sentiment in the year that followed, negative sentiment then took over much of 2018 again before prices started to trend higher in 2019. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets.

So you better start off slow, learn and open a demo account first. If you want to study more, check out our blog post about the best trading apps for learning. When you trade forex on leverage and hold your position overnight, a fee will be charged.

Trader sentiment can be used to determine positioning across a range of assets. Our forex market sentiment indicator shows the percentage of traders going long and short, how sentiment is shifting, and whether the overall signal is bullish, bearish or mixed. Sentiment indicators are numeric or graphic representations of how optimistic or pessimistic traders are about market conditions. This can refer to the percentage of trades that have taken a given position in a currency pair. For example, 70% of traders going long and 30% going short will simply mean 70% of traders are long on the currency pair.

As rule of thumb, economic growth means future prosperity which then equals to a strengthening of the country’s currency. Traders look for these upticks in economic growth (positive economic releases) as they usually offer opportunities to jump on an uptrend. In contrast, economic reports showing a slack in economic growth result in the weakening of the country’s currency. So, the future value of a currency is defined based on whether the actual data hits, misses or exceeds the forecast level. Investors typically describe market sentiment as bearish or bullish.

Thomson Reuters/University of Michigan and the Conference Board both publish a monthly consumer confidence and attitude survey. The Institute for Business Cycle Analysis publishes a monthly consumer demand survey known as US Consumer Demand Indices. Leveraged trading in foreign currency carries a high level of risks and may not be suitable to everyone. Forex Live are very quick to post information to their news updates. You will be working with a team of veteran traders when using this site which is one reason why they are always up to date on news coverage.

Комментарии

Отправить комментарий