Technical Analysis Strategies for Beginners

Technical Analysis Strategies for Beginners

This tool is normally used with other technical analysis tools in order to find an opportunity. MACD is calculated by subtracting the 26- day exponential moving average (EMA) to 12- day EMA.

Many investors analyze stocks based on their fundamentals – such as their revenue, valuation or industry trends – but fundamental factors aren't always reflected in the market price. Technical analysis seeks to predict price movements by examining historical data, mainly price and volume. Academics largely see technical analysis as pseudoscientific nonsense. Stock prices are random, says efficient market theorist Burton Malkiel, author of the classic A Random Walk on Wall Street. Investors who rely on technical analysis “will accomplish nothing but increasing substantially the brokerage charges they pay”, he writes.

It is also perceived that the percentage of stock above its moving average helps to determine the overall health of the market. Once the value of moving average has been calculated, you have to simply plat a chart of 200-day moving average price or 50 days, 20 days, a 10-day moving average line based on your choice.

The slow line is a 9-period moving average of the MACD fast line. The MACD slow line is a moving average of the MACD fast line.

Long-term traders who hold market positions overnight and for long periods of time are more inclined to analyze markets using hourly, 4-hour, daily, or even weekly charts. The first step is to identify a strategy or develop a trading system. For example, a novice trader may decide to follow a moving average crossover strategy, where he or she will track two moving averages (50-day and 200-day) on a particular stock price movement. Many trend traders use the RSI to capture the last few stretches of a strong trend.

One thing to note about MACD is that it’s made up of moving averages of other moving averages. This means that it lags behind price quite a lot, so might not be the best indicator to use if you want to get into trends early. The price tends to bounce from one side of the band to the other, always returning to the moving average. Low volatility indicates small price moves, high volatility indicates big price moves. High volatility also suggests that there are price inefficiencies in the market, and traders spell “inefficiency”, P-R-O-F-I-T.

Don’t get too attached to the direction of the market, as long as the price is moving you can profit. Trend indicators tell you which direction the market is moving in, if there is a trend at all.

The typical doji is the long-legged doji, where price extends about equally in each direction, opening and closing in the middle of the price range for the time period. The appearance of the candlestick gives a clear visual indication of indecision in the market. When a doji like this appears after an extended uptrend or downtrend in a market, it is commonly interpreted as signaling a possible market reversal, a trend change to the opposite direction.

- This course can also help you prepare for the Chartered Market Technicians (CMT) exam.

- If you are focused on intra-day trades, you may not care about what a stock's daily trend (although it's still important to be aware of it).

- Trend trading is one of the hottest strategies in the current investing world.

- In this example you can see that when a price returns to one of the previous support levels inside the green boxes it bounces back up.

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Another thing to keep in mind is that you must never lose sight of your trading plan.

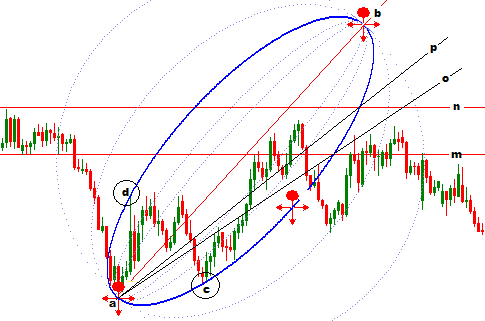

This seemingly complex form of market analysis can be intimidating to some, however understanding a few basic principles will help you filter out the noise and develop an applicable strategy. This is because the most important measure of a market’s past and current performance is the price itself; this is the starting point when delving into analyzing the potential of a trade. Price action can be represented on a chart as this is the clearest indication of what the price is doing. Pivot and Fibonacci levels are worth tracking even if you don’t personally use them as indicators in your own trading strategy. Fibonacci levels are another popular technical analysis tool.

The seminar can be live-streamed online because it doesn’t just teach technical principles. Participants are taught to create their own investing and trading strategies to discover what works best for them. The course leader will dissect sample problems from past market charts and talk about their trading experiences.

Though a “fundamentally-oriented person”, Josh Brown of Ritholtz Wealth Management “can’t imagine doing without charts in some way, shape or form”. Technicians often say price has memory, and keep a close eye on so-called support and resistance levels. For example, the Euro Stoxx 600 index is currently just below the 400 level, which marked major market tops in 2000, 2007 and 2015.

However, using fundamental analysis for such a short-term trade is not possible. In such a scenario, technical analysis is the only type of research that can provide traders some idea about the direction of the stock price. There are several automated tools available today that can pull out technical information according to your preference.

What Makes a Great Technical Analysis Course?

Each candlestick on an hourly chart shows the price action for one hour, while each candlestick on a 4-hour chart shows the price action during each 4-hour time period. However, the same price action viewed on an hourly chart (below) shows a steady downtrend that has accelerated somewhat just within the past several hours. A silver investor interested only in making an intra-day trade would likely shy away from buying the precious metal based on the hourly chart price action.

For example, we often use VWAP to gauge a stock's relative strength on an intra-day chart. Similarly, many traders will use stochastics, RSI, and MACD to do the same. There is no such thing as good or bad technical indicators; it all comes down to how you use them. It’s important to keep in mind that support/resistance levels exist across multiple timeframes. You are trading alongside day traders, swing traders, and investors, all of whom may have different price targets.

Комментарии

Отправить комментарий